UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant þ Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

þ Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material under Rule 14a-12

CHEMICAL FINANCIAL CORPORATION

(Name of Registrant as Specified in Its Charter)

(Name of person(s) filing proxy statement, if other than the registrant)

Payment of Filing Fee (Check the appropriate box):

þ No fee required.

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

(1)Title of each class of securities to which transaction applies:

(2)Aggregate number of securities to which transaction applies:

| |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

(4)Proposed maximum aggregate value of transaction:

(5)Total fee paid:

¨ Fee paid previously with preliminary materials.

¨ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

| |

| (1) | Amount Previously Paid: |

| |

| (2) | Form, Schedule or Registration Statement No.: |

March 10, 2017

235 East Main333 W. Fort Street, Suite 1800

Midland,Detroit, Michigan 48640

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

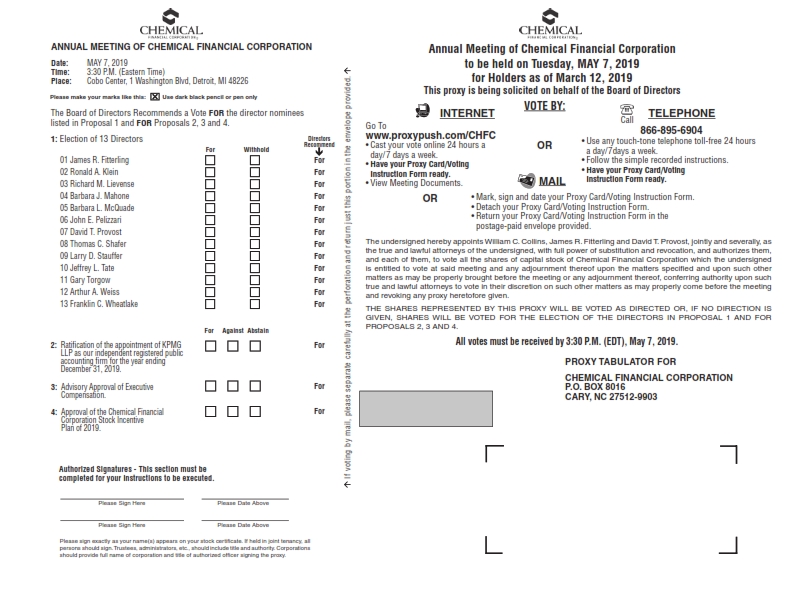

To Be Held April 26, 2017May 7, 2019

To Our Shareholders:

The 2017I cordially invite you to attend the 2019 annual meeting of shareholders of Chemical Financial Corporation willto be held at the MidlandCobo Center, 1 Washington Boulevard, Detroit, Michigan, on Tuesday, May 7, 2019, at 3:30 p.m. local time, for the Arts, 1801 W. St. Andrews Drive, Midland, Michigan, on Wednesday, April 26, 2017, at 2:00 p.m. local time. At the meeting, we will consider and vote on:following purposes:

| |

| 1. | Election of 12to elect 13 directors; |

| |

| 2. | Amendment of our Restated Articles of Incorporation to increase the number of authorized shares of our common stock from 100,000,000 shares to 135,000,000 shares; |

| |

3. | Approval of the Stock Incentive Plan of 2017; |

| |

4. | Ratification ofratify the appointment of KPMG LLP as our independent registered public accounting firm for the year ending December 31, 2017;2019; |

| |

5.3. | Advisory approvalto conduct an advisory vote on the compensation of our named executive compensation;officers; and |

| |

6.4. | Advisory vote onto approve the frequencyChemical Financial Corporation Stock Incentive Plan of the advisory approval of executive compensation.2019. |

We will also conduct any other business that properly comes before the meeting or at any adjournment of the meeting.

You are receiving this notice and can vote at the meeting and any adjournment of the meeting if you were a shareholder of record as of the close of business on February 27, 2017.March 12, 2019. The enclosed proxy statement and proxy are first being sent to our shareholders on approximately March 10, 2017.26, 2019. A copy of our annual report for the year ended December 31, 20162018 is enclosed with this notice.

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to be Held on April 26, 2017.May 7, 2019. OurAgain this year, we are taking advantage of the rules of the SEC that allow us to furnish our proxy statement and annual report formaterials over the year ended December 31, 2016, which accompany this notice,Internet. We are available for viewing, printing and downloadingmailing to our shareholders a Notice of Internet Availability of Proxy Materials, rather than mailing a full paper set of the materials. The Notice of Internet Availability of Proxy Materials contains instructions on how to access our proxy materials on the internet at Internet, as well as instructions on obtaining a paper or email copy of the proxy materials. This process will reduce our costs to print and distribute our proxy materials.

www.edocumentview.com/chfcWe urge you to please vote your shares now whether or not you plan to attend the meeting. Voting by the Internet or telephone is fast and convenient, and your vote is immediately confirmed and tabulated. If you request to receive a paper copy of the proxy materials, you may also vote by completing, signing, dating and returning the accompanying proxy card in the “Investor Information” section of our website, www.chemicalbankmi.com,enclosed return envelope furnished for that purpose. By using the Internet or voting by clicking the 2017 Proxy Statementtelephone, you help us reduce postage and 2016 Annual Report links, respectively. In addition, you may obtain electronic copies of all of our filings with the U.S. Securities and Exchange Commission during the last five years from this section of our website.proxy tabulation costs.

We look forward to seeing you at the meeting.

By Order of the Board of Directors,

David B. RamakerT. Provost

Chief Executive Officer and President

March 10, 201726, 2019

|

| | |

| Your vote is important.

Even if you plan to attend the meeting,

PLEASE SIGN, DATE AND RETURN THE ENCLOSED PROXY PROMPTLY OR

VOTE BY TELEPHONE OR THE INTERNET.

| |

CHEMICAL FINANCIAL CORPORATION

PROXY STATEMENT

Table of Contents

CHEMICAL FINANCIAL CORPORATION

PROXY STATEMENT

dated March 10, 201726, 2019

For the Annual Meeting of Shareholders

to be held April 26, 2017May 7, 2019

Introduction

Use of Terms

In this proxy statement, “we,” “us,” “our,” the “Company,”"Chemical," or the “Corporation” and “Chemical Financial” refer to Chemical Financial Corporation, the “Bank” refers to Chemical Bank, and “you” and “your” refer to each shareholder of Chemical Financial Corporation.

Questions and Answers about the Proxy Materials and Our 20172019 Annual Meeting

| |

Q. | Why am I receiving these materials? |

| |

A. | Chemical Financial’sOur board of directors is providing these proxy materials to you in connection with its solicitation of proxies for use at the Chemical Financial Corporation 20172019 annual meeting of shareholders. The meeting will take place on Wednesday, April 26, 2017,Tuesday, May 7, 2019, at 2:003:30 p.m. local time, at the MidlandCobo Center, for the Arts, 1801 W. St. Andrews Drive, Midland,1 Washington Boulevard, Detroit, Michigan. You are invited to attend the meeting and are requested to vote on the proposals described in this proxy statement. |

| |

| Q. | What proposals will be voted on at the annual meeting? |

| |

A. | The following proposals are scheduled to be voted on at the annual meeting: |

Election of 12 directors (Proposal 1);Proposal 1 – to elect 13 directors;

Amendment of our Restated Articles of IncorporationProposal 2 – to increase the number of authorized shares of our common stock from 100,000,000 shares to 135,000,000 shares (Proposal 2);

Approval of the Stock Incentive Plan of 2017 (Proposal 3);

Ratification ofratify the appointment of KPMG LLP as our independent registered public accounting firm for the year ending December 31, 2017 (Proposal 4);2019;

Advisory approvalProposal 3 – to approve, on a non-binding, advisory basis, the compensation of our named executive compensation (Proposal 5);officers; and

Advisory vote onProposal 4 – to approve the frequencyChemical Financial Corporation Stock Incentive Plan of the advisory approval of executive compensation (Proposal 6).2019.

In addition, any other business that properly comes before the meeting will be considered and voted on. As of the date of this proxy statement, we are not aware of any other matters to be considered and voted on at the meeting. If any other matters are presented, the persons named as proxies on the enclosed proxy will have discretionary authority to vote for you on those matters.

| |

| Q. | What information is contained in these materials? |

| |

A. | The information included in this proxy statement discusses the proposals to be voted on at the meeting, the voting process, the compensation of our directors and named executive officers, and certain other required information. YourIf you requested printed copies of the proxy materials to be sent to you by mail, your proxy, which you may use to vote on the proposals described in this proxy statement, is also enclosed. |

| |

| Q. | When did the Company begin sending and delivering this proxy statement and the enclosed proxy to shareholders? |

| |

A.

| We began sending and delivering this proxy statement and the enclosed proxyto our shareholders on approximately March 10, 2017.

|

| |

Q. | How does the Company’sChemical board of directors recommend that I vote? |

| |

A. | Your board of directors recommends that you vote FOR approval of Proposals 1, 2, 3, 4, and 5, and ONE YEAR on Proposal 6. vote: |

FOR each nominee to the board of directors;

FOR the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for the year ending December 31, 2019;

FOR the approval, on an advisory basis, of the compensation of our named executive officers; and

FOR the approval of the Chemical Financial Corporation Stock Incentive Plan of 2019.

| |

A. | You may vote at the annual meeting if you were a shareholder of record of Chemical Financialour common stock at the close of business on February 27, 2017.March 12, 2019. Each shareholder is entitled to one vote per share of Chemical Financialour common stock on each matter presented for a shareholder vote at the meeting. As of February 27, 2017, there were 71,068,446 shares of Chemical Financial common stock issued and outstanding. |

shareholder vote at the meeting. As of the March 12, 2019 record date, there were 71,538,472 shares of Chemical common stock issued and outstanding.

We anticipate that the Notice of Internet Availability of Proxy Materials will first be sent to shareholders on or about March 26, 2019. The proxy statement and the form of proxy relating to the annual meeting are first being made available to shareholders on or about March 26, 2019.

| |

| Q. | How doWhy did I vote?receive a Notice of Internet Availability of Proxy Materials instead of paper copies of the proxy materials? |

| |

A. | Again this year, pursuant to the SEC “Notice and Access” rules, we are furnishing our proxy materials to our shareholders over the Internet instead of mailing each of our shareholders paper copies of those materials. As a result, we will send our shareholders by mail a Notice of Internet Availability of Proxy Materials, which we refer to as the Notice, containing instructions on how to access our proxy materials over the Internet and how to vote. The Notice is not a ballot or proxy card and cannot be used to vote your shares of common stock. The Notice also tells you how to access your proxy card to vote on the Internet. If you properly signreceived a Notice by mail and returnwould like to receive a printed or email copy of the enclosed proxy materials, please follow the shares representedinstructions included in the Notice. You will not receive paper copies of the proxy materials unless you request the materials by that proxy will be votedfollowing the instructions on the Notice. |

If you own shares of common stock in more than one account – for example, in a joint account with your spouse and in your individual brokerage account – you may have received more than one Notice. To vote all of your shares of common stock, please follow each of the separate proxy voting instructions that you received for your shares of common stock held in each of your different accounts.

| |

| Q. | What is the quorum requirement for the annual meeting? |

| |

A. | To conduct business at the annual meeting, and at any adjournmenta quorum of shareholders must be present. The presence in person or by properly executed proxy of the meeting.holders of a majority of all issued and outstanding shares of our common stock entitled to vote at the meeting is necessary for a quorum. To determine whether a quorum is present, we will include shares that are present or represented by proxy, including abstentions and shares represented by a broker non-vote on any matter. |

| |

| Q. | What are broker non-votes? |

| |

A. | Generally, broker non-votes occur when shares held by a broker in street name for a beneficial owner are not voted with respect to a particular proposal because the broker has not received timely voting instructions from the beneficial owner and the broker lacks discretionary voting power to vote those shares. In these cases, the broker can register your shares as being present at the meeting for purposes of determining the presence of a quorum but will not be able to vote on those matters for which specific authorization is required under the rules of the New York Stock Exchange. |

| |

| Q. | Does my broker have discretionary authority to vote my shares? |

| |

A. | If you do not provide your broker with voting instructions, then your broker only has discretionary authority to vote your shares on certain “routine” matters. We expect that Proposal 2 will be considered a routine matter and your broker will have discretionary authority to vote your shares on such proposal. Proposals 1, 3 and 4 are not considered routine matters and your broker will not have discretionary authority to vote your shares on these matters. It is important that you promptly provide your broker with voting instructions if you want your shares voted on Proposals 1, 3 and 4. |

| |

| Q. | How do I vote if I hold my shares directly? |

| |

A. | If you hold shares in your own name, you may vote by selecting any of the following options: |

If you specify a choice on the proxy, your shares will be voted as specified. If you do not specify a choice, your shares will be voted for approval of Proposals 1, 2, 3, 4 and 5, and ONE YEAR on Proposal 6. If any other matter comes before the meeting, your shares will be voted at the discretion of the persons named as proxies on the proxy.

If you are a shareholder of record, Chemical Financial also offers you the convenience of voting by telephone or through the Internet, 24 hours a day, seven days a week.

Internet Voting. You may vote via the Internet 24 hours a day, seven days a week, by visiting www.envisionreports.com/chfc.www.proxypush.com/CHFC. Follow the steps outlined on the secure website.

Telephone Voting. ToYou may vote via telephone 24 hours a day, seven days a week, by telephone, dialdialing the toll-free number on the instructions included on your proxy and listenlistening for further directions.

By Mail. If you request printed copies of the proxy materials to be sent to you by mail, you can complete the proxy card, date and sign it, and return it in the postage-paid envelope provided.

Shares represented by signed proxies will be voted as instructed. If you sign the proxy but do not mark your vote, your shares will be voted as the directors have recommended.

If you acquired your shares through the stock purchase and dividend reinvestment plan or if you hold your shares in street name, see the instructions below.

| |

| Q. | How do I vote my shares acquired through the stock purchase and dividend reinvestment plan (Computershare CIP)? |

| |

| A. | If you are enrolled in Chemical Financial’sour stock purchase and dividend reinvestment plan (Computershare CIP), the enclosed proxy covers: (1) all shares of Chemical Financial’sour common stock owned of record by you at the record date, and (2) all shares of Chemical Financial’sour common stock held by you in the Computershare CIP at that time. Computershare, as agent under the Computershare CIP, will vote any common stock held by it under the Computershare CIP in accordance with your written direction as indicated on the proxy. All such shares will be voted the way you direct. If no specific instruction is given on a returned proxy, Computershare will vote as recommended by the board of directors. |

| |

| Q. | How do I vote if I hold my shares in “street name”? |

| |

A. | If you hold your shares in “street name,” which means that your shares are registered in the name of a bank, broker or other nominee (which we collectively refer to as your “broker”), your broker must vote your street name shares in the manner you direct if you provide your broker with proper and timely voting instructions. Please use the voting forms and instructions provided by your broker or its agent. These forms and instructions typically permit you to give voting instructions by telephone or the Internet if you wish. If you are a street name holder and want to change your vote, you must contact your broker. Please note that you may not vote shares held in street name in person at the annual meeting unless you request and receive a valid proxy from your broker. |

| |

| Q. | Does my broker have discretionary authority to vote my shares? |

| |

A.

| If you do not provide your broker with voting instructions, then your broker has discretionary authority to vote your shares on certain “routine” matters. We expect that Proposals 2 and 4 will be considered a routine matter and your broker will have discretionary authority to vote your shares on the proposals. Proposals 1, 3, 5 and 6 are not considered routine matters and your broker will not have discretionary authority to vote your shares on these matters. It is important that you promptly provide your broker with voting instructions if you want your shares voted on Proposals 1, 3, 5 or 6.

|

| |

Q. | Can I change my mind after I return my proxy? |

| |

A. | Yes. If you are a shareholder of record (i.e., you hold your shares directly instead of through a brokerage account) and you change your mind after you return your proxy or you vote electronically over the Internet or by telephone, you retain the power to revoke your proxy or change your vote. You may revoke your proxy at any timeor change your vote before it is voted at the meeting by doing either of the following two things:by: |

bytimely delivering written notice of revocation to Chemical Financial’sour Corporate Secretary, William C. Collins, at 235 E. Main Street, Midland, Michigan 48640;

timely delivering a new valid proxy bearing a later date either by mail, electronic vote over the Internet or by telephone; or

by attending the meeting and voting in person.

If you hold your shares through a brokerage account, you must contact your brokerage firm to revoke your proxy.

| |

Q. | What are broker non-votes? |

| |

A.

| Generally, broker non-votes occur when shares held by a broker in street name for a beneficial owner are not voted with respect to a particular proposal because the broker has not received timely voting instructions from the beneficial owner and the broker lacks discretionary voting power to vote those shares. In these cases, the broker can register your shares as being present at the meeting for purposes of determining the presence of a quorum but will not be able to vote on those matters for which specific authorization is required under the rules of the New York Stock Exchange. |

| |

Q. | What is the quorum requirement for the annual meeting? |

| |

A.

| To conduct business at the annual meeting, a quorum of shareholders must be present. The presence in person or by properly executed proxy of the holders of a majority of all issued and outstanding shares of Chemical Financial common stock entitled to vote at the meeting is necessary for a quorum. To determine whether a quorum is present, we will include shares that are present or represented by proxy, including abstentions and shares represented by a broker non-vote on any matter. |

| |

| Q. | What vote is necessary to approve the proposals? |

| |

A. | Proposal 1: Election of Directors. A plurality of the shares voting is required to elect directors. This means that, if there are more nominees than positions to be filled, the nominees who receive the most votes |

Standard. Assuming a quorum is present, directors will be elected to the open director positions. Abstentions, broker non-votes and other shares that are not voted in person or by proxy will not be included in the vote count. In the event that a nominee currently serving as a director receives a greater number of votes “withheld” from his or her election than votes “for” his or her election, such nominee must promptly tender his or her resignation to the board of directors. The Corporate Governance and Nominating Committee must promptly consider the resignation and recommend to the board of directors whether to accept or reject the resignation. The board of directors then must act on the committee’s recommendation and determine whether to accept or reject the resignation.

Proposal 2. Proposal 2 will be approved if a majority of the shares entitled to vote are voted in favor of the proposal. Abstentions, broker non-votes and other shares that are not voted on Proposal 2 in person or by proxy will have the same effect as votes against this proposal.

Proposals 3, 4 and 5. Proposals 3, 4 and 5 will be approved if a majority of the shares that are voted on each proposal at the meeting are voted in favor of each proposal. Abstentions, broker non-votes and other shares that are not voted on Proposals 3, 4 and 5 in person or by proxy will not be included in the vote count.

Proposal 6. On Proposal 6, you may vote that an advisory vote on executive compensation should occur every one, two, or three years, or you may abstain from voting. This proposal will be determined by a plurality of the shares voting. Abstentions,votes cast. This means that the 13 nominees who receive the largest number of "FOR" votes cast will be elected as directors. In the event that a nominee currently serving as a director receives a greater number of votes "withheld" from his or her election than votes "for" his or her election, such nominee must promptly tender his or her resignation to the board of directors. The Corporate Governance and Nominating Committee must promptly consider the resignation and recommend to the board of directors whether to accept or reject the resignation. The board of directors then must act on the committee’s recommendation and determine whether to accept or reject the resignation. Shareholders do not have cumulative voting rights.

Effect of abstentions and broker non-votes. If you fail to vote, mark “ABSTAIN” on your proxy card, or fail to instruct your bank or broker how to vote with respect to Proposal 1, you will be deemed not to have cast a vote with respect to the proposal and other shares that are not voted in person or by proxyit will not be included inhave no effect on the vote count.proposal.

Required VoteProposal 2:Ratification of the appointment of KPMG LLP as our independent registered public accounting for Other Matters.2019.

Standard. We do not knowAssuming a quorum is present, this proposal requires the affirmative vote of any other matters to be presented at the meeting. Generally, any other proposal to be voted on at the meeting would be approved if a majority of the shares that are votedvotes cast at the meeting.

Effect of abstentions and broker non-votes. If you fail to vote, mark “ABSTAIN” on your proxy card, or fail to instruct your bank or broker how to vote with respect to Proposal 2, you will be deemed not to have cast a vote with respect to the proposal and it will have no effect on the proposal.

Proposal 3:Approval, on an advisory basis, of the compensation of our named executive officers.

Standard. Assuming a quorum is present, this proposal requires the affirmative vote of a majority of the votes cast at the meeting are voted in favormeeting.

Effect of abstentions and broker non-votes. If you fail to vote, mark “ABSTAIN” on your proxy card, or fail to instruct your bank or broker how to vote with respect to Proposal 3, you will be deemed not to have cast a vote with respect to the proposal and it will have no effect on the proposal.

Proposal 4:Approval of the proposal. Abstentions,Chemical Financial Corporation Stock Incentive Plan of 2019.

Standard. Assuming a quorum is present, this proposal requires the affirmative vote of a majority of the votes cast at the meeting.

Effect of abstentions and broker non-votes. If you fail to vote, mark “ABSTAIN” on your proxy card, or fail to instruct your bank or broker how to vote with respect to Proposal 4, you will be deemed not to have cast a vote with respect to the proposal and other shares that are not votedit will have no effect on the proposal in person or by proxy would not be included in the vote count.proposal.

| |

| Q. | May the annual meeting be adjourned? |

| |

A. | Yes. TheUnder our bylaws, the Chair of the board or, in his absence the Chief Executive Officer or other presiding officer may, in his or her discretion, adjourn or postpone a meeting of shareholders regardless of whether a quorum is present. In addition, the shareholders present at the meeting, in person or by proxy, may by a majority vote, adjourn the meeting despite the absenceregardless of whether a quorum.quorum is present. Shares represented by proxy may be voted at the discretion of the proxy holder on a proposal to adjourn the meeting. |

| |

| Q. | What does it mean if I receive more than one proxy or voting instruction card?Notice of Internet Availability of Proxy Materials? |

| |

A. | It means your shares are registered differently or are in more than one account. Please provide voting instructions for all proxies and voting instruction cards you receive.of your shares. |

| |

| Q. | Where can I find the voting results of the annual meeting? |

| |

A. | We will announce preliminary voting results at the annual meeting and publish final results in a Current Report on Form 8-K that will be filed with the Securities and Exchange Commission (SEC) within four business days afterof the date of the annual meeting. |

Overview of Proposals

This proxy statement contains six proposals requiring shareholder action. Proposal 1 requests the election of 12 directors to the board of directors. Proposal 2 requests approval of an amendment of our Restated Articles of Incorporation to increase the number of authorized shares of our common stock from 100,000,000 shares to 135,000,000 shares. Proposal 3 requests approval of the Stock Incentive Plan of 2017. Proposal 4 requests the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for the year ending December 31, 2017. Proposal 5 requests advisory approval of our executive compensation. Proposal 6 requests an advisory vote on the frequency of the advisory approval of our executive compensation.

Proposal 1

Election of 1213 Directors

Following aEach director listed below has been nominated by our board of directors, following review and nomination from therecommendation by our Corporate Governance and Nominating Committee, the board of directors proposes that the following nominees be elected as directors for termsto serve a one-year term expiring at the 2018our 2020 annual meeting of shareholders:shareholders or until that person's successor is duly elected and qualified:

James R. Fitterling

Ronald A. Klein

Richard M. Lievense

Barbara J. Mahone

Barbara L. McQuade

John E. Pelizzari

David T. Provost

David B. RamakerThomas C. Shafer

Larry D. Stauffer

Jeffrey L. Tate

Gary Torgow

Arthur A. Weiss

Franklin C. Wheatlake

Each proposed nominee currently serves as a director of Chemical Financial Corporation and Chemical Bank for a term that will expire at this year’s annual meeting. Mr. Gary E. Andersonmeeting or until that person's successor is currentlyduly elected and qualified. Each nominee has agreed to serve as a director of Chemical Financial. Mr. Anderson will retire from the board of directors effective at the annual meeting on April 26, 2017 after serving over twelve years on the board of directors of Chemical Financial . The proposed nominees are willing to be elected and serve as directors.if elected. If a nominee is unable to serve or is otherwise unavailable for election, which we do not anticipate, the incumbent board of directors may or may not select a substitute nominee. If a substitute nominee is selected, your proxy will be voted for the person selected. If a substitute nominee is not selected, your proxy will be voted for the election of the remaining nominees. No proxy will be voted for a greater number of persons than the number of nominees named above.

Biographical information concerning theeach of our director nominees for director of Chemical Financial appears below under the heading “Board of Directors.” Each of the current directors and nominees for director other than David B. Ramaker,T. Provost, Thomas C. Shafer, Gary Torgow and Richard M. Lievense Gary Torgow, and David T. Provost, qualified as independent directors as defined by NASDAQ Listing Rules,listing rules, including such definitions applicable to each committee of the board of directors upon which he or she serves or served. In making this determination, the board of directors considered all ordinary course loan and other business transactions between the directors and Chemical Bank.

Your Board of Directors and the Corporate Governance and Nominating Committee

recommendrecommends that you vote FOR the election of all nominees as directors.

Proposal 2

Amendment of our Restated Articles of Incorporation to increase the number of

authorized shares of common stock from 100,000,000 shares to 135,000,000 shares

The board of directors proposes to amend Article IIIRatification of the Corporation’s Restated Articlesappointment of Incorporation to increaseKPMG LLP as our independent

registered public accounting firm for the number of authorized shares of our common stock from 100,000,000 shares to 135,000,000 shares. The purpose of the amendment is to provide additional shares for future issuance.

The board of directors has unanimously approved, and recommends that the Corporation’s shareholders approve, the proposed amendment to the Restated Articles of Incorporation. The board of directors determined the approval of the proposed amendment to increase the number of authorized shares of common stock would be in the best interests of the Corporation and its shareholders.

We currently have 100,000,000 shares of common stock authorized for issuance and 2,000,000 shares of preferred stock authorized for issuance. As of February 27, 2017, 71,068,446 shares of common stock of the 100,000,000 shares authorized for issuance were issued and outstanding and 2,571,337 shares were reserved for issuance under the Corporation’s share-based plans leaving us with 26,360,217 shares of common stock available for future issuance. As of February 27, 2017, no shares of preferred stock were issued and outstanding.year ending December 31, 2019

The boardAudit Committee has appointed KPMG LLP as our independent registered public accounting firm to audit our consolidated financial statements as of directors believes that it is advisable to have a sufficient amount of additional authorized shares of common stock available for future issuance for important corporate purposes and provide the ability to react quickly to strategic opportunities. Acquisitions of other organizations continues to be a key strategy for the long-term growthyear ending December 31, 2019 and the effectiveness of the Corporation. Authorized but unissued sharesinternal control over financial reporting as of common stock,December 31, 2019, and to perform such other appropriate audit-related accounting, tax compliance or funds raised in a public offering of shares,other tax services as may be used for these purposes. The additional authorized shares would also be available for possible future stock splits and dividends, equity incentive plans, equity compensation plans to attract and retain talented employees and other corporate purposes that might be considered. The Corporation has no present plans or proposals to issue the additional shares that would be authorizedapproved by the proposed amendment.

All of the additional authorized shares of common stock would be of the same class with the same dividend, voting,Audit Committee. The Audit Committee and liquidation rights as the shares of common stock presently issued and outstanding. If Proposal 2 is approved, our authorized capital stock would continue to include 2,000,000 shares of preferred stock. Shareholders have no preemptive rights to acquire shares of common stock issued by the Corporation under its Restated Articles of Incorporation and shareholders would not acquire preemptive rights with respect to the additional authorized shares of stock under the proposed amendment to the Restated Articles of Incorporation.

The issuance of additional shares of common stock could dilute the voting rights, equity and earnings per share of existing shareholders. The issuance of additional shares of common stock, or the perception that additional shares may be issued, may also adversely affect the market price of our common stock. The additional shares of common stock that would become available for issuance if the amendment is approved could also be used by us to oppose a hostile takeover attempt or to delay or prevent changes in control or management of the Corporation. For example, without further shareholder approval, the board of directors could strategically sell sharespropose and recommend that shareholders ratify the appointment of common stock in a private transaction to purchasers who would oppose a takeover or favorKPMG LLP as our independent registered public accounting firm for the current board of directors. Althoughyear ending December 31, 2019.

More information concerning our relationship with KPMG LLP appears below under the amendment to increasesubheading “Board Committees–Audit Committee” and the authorized shares of common stock has been prompted by the businessheadings “Audit Committee Report” and financial considerations described above, and not by the threat of any hostile takeover attempt (nor is the board of directors currently aware of any such attempts directed at us), shareholders should be aware that approval of the amendment could facilitate future efforts by us to deter or prevent changes in control.

If the proposed amendment is adopted, the newly authorized shares would be unreserved and available for issuance. No further shareholder authorization would be required prior to the issuance of such shares by the Corporation, except where shareholder approval is required under NASDAQ rules.

“Independent Registered Public Accounting Firm.”

If the shareholders approve Proposal 2, wedo not ratify the appointment of KPMG LLP, the Audit Committee will fileconsider a Certificate of Amendment to our Restated Articles of Incorporation to amend the first paragraph of Article III, in its entirety, to read as follows:

The total authorized capital stockchange of the Corporation is 137,000,000 shares of stock divided into two classes, as follows:

A. 135,000,000 shares of common stock, par value $1.00 per share; and

B. 2,000,000 shares of preferred stock, no par value.

Exceptindependent registered public accounting firm for the first paragraph, all of the remaining provisions in Article III of the Restated Articles of Incorporation would remain in full force and effect without change. The text of the proposed amendment is subject to modification to include such changes as the board of directors determines to be necessary or advisable to effect the increase in authorized shares of common stock.next year.

Your Board of Directors and the Audit Committee

recommends that you vote FOR Proposal 2.

Proposal 3

Advisory Approval of Executive Compensation

The Dodd-Frank Wall Street Reform and Consumer Protection Act (the Dodd-Frank Act) requires, among other things, that we hold a non-binding, advisory vote to approve the compensation of our named executive officers, as disclosed pursuant to Item 402 of Regulation S-K in this proxy statement.

This proposal (sometimes referred to as a Say-on-Pay proposal) gives you, as a shareholder, the opportunity to approve or not approve our executive compensation through the following resolution:

“Resolved, that the compensation paid to our named executive officers as disclosed pursuant to Item 402 of Regulation S-K, including the Compensation Discussion and Analysis, compensation tables, and narrative discussion is hereby approved.”

We believe that our executive compensation programs and policies appropriately align named executive officers’ incentives with shareholder interests and are designed to attract and retain high quality executive talent. We believe that our executive compensation programs and policies are and have been competitive within the industry and in comparison with the compensation programs and policies of competitors in the markets that we serve. We also believe that both Chemical and our shareholders benefit from responsive corporate governance policies and dialogue.

This vote is advisory, which means that it is not binding on us or the board of directors, and may not be construed as overruling a decision by the board of directors or creating an additional fiduciary duty of the board of directors. However, the Compensation and Pension Committee will take into account the outcome of the vote when considering future executive compensation decisions.

Our current policy is to provide shareholders with an opportunity to approve executive compensation each year at the annual meeting of shareholders. The next such vote is scheduled to occur at the 2020 annual meeting of shareholders.

Your Board of Directors and the Compensation and Pension Committee

recommends that you vote FOR Proposal 3.

Proposal 34

Approval of the Stock Incentive Plan of 2017

The Chemical Financial Corporation Stock Incentive Plan of 20152019

The purpose of the Chemical Financial Corporation Stock Incentive Plan of 2019 (the “2015“2019 Stock Plan”) was approvedis to advance our long-term interests by aligning the interests of our officers, directors and key employees with those of our shareholders atthrough equity-based awards. Our board of directors also believes that equity-based awards are necessary to attract, retain and motivate officers, directors and key employees of exceptional abilities, and to recognize the 2015 annual meeting of shareholders. significant contributions these individuals have made to our long-term performance and growth.

Under the 2015Chemical Financial Corporation Stock Incentive Plan 626,353of 2017 (the “2017 Stock Plan”), 1,301,285 shares remained available for issuance as of December 31, 2016.2018. Because there are a limited number of shares available for issuance under the 20152017 Stock Plan, theour board of directors believes that it is advisable to implement the 2019 Stock Plan, which will make additional shares available for restricted stock units (including both performance-based restricted stock performance units and time-vesting restricted stock service-based units), stock options and other equity-based awards. Rather than reload the 2015The 2019 Stock Plan, the board of directors believes it is in the best interest of the Corporation and its shareholders to establish the Chemical Financial Corporation Stock Incentive Plan of 2017 (the “2017 Stock Plan”) toif approved, will replace the 20152017 Stock Plan.

Important Considerations

The board of directors believes aPlan and no new plan is warranted for several reasons. In connection with the recent merger with Talmer Bancorp, Inc. (“Talmer”), the Corporation issued a number of equity-based awards to retain personnel following announcement of the merger. In addition, the Corporation is significantly larger in size following the Talmer merger, with many more employees. The board of directors expects that the Corporation will need more shares available for potential equity-based awards due to the significant increase in the number of employees. Moreover, as a result of the Talmer merger, the Corporation entered into a new peer group for purposes of comparing compensation plans and practices, as well as corporate performance. The board of directors expects that the Corporation’s compensation practices will change in response to the practices of the members of its new peer group, all of which are much larger in size when compared to the members of the Corporation’s previous peer group. A new plan provides additional flexibility to make awards that were not availablebe granted under the 2015 Stock Plan.

The Pension and Compensation Committee has adopted and approved, and recommended that the board of directors adopt and approve, the 2017 Stock Plan. TheHowever, any awards outstanding under the 2017 Stock Plan, and any prior plan, will continue to be outstanding and governed by the provisions of the applicable plans.

If the 2019 Stock Plan is not approved by our shareholders, it will not be adopted and we will continue to operate under the 2017 Stock Plan until it expires. In the event the 2019 Stock Plan is not approved, our flexibility may be limited with respect to our ability to provide incentives and reward employees and directors, to attract and retain such persons on a competitive basis and to align the interests of such persons with ours.

On the approval and recommendation of our Compensation and Pension Committee (the “Compensation Committee”), the board of directors has adopted and approved the 2019 Stock Plan, subject to shareholder approval, and recommends that the Corporation’s shareholders approve, the 2017 Stock Plan because itapproval. The board of directors believes that the design of the 20172019 Stock Plan and the number of shares to be authorized for issuance under the plan are consistent with the interests of shareholders and good corporate governance practices. In adopting and approving the 20172019 Stock Plan, the board of directors was mindful of investor considerations relating to the 2017 Stock Plan,plan, including the following:

Important Plan Features

The total number of shares available for issuance under the 20172019 Stock Plan will be 1,750,000.2,400,000. The 20172019 Stock Plan includes, among other things, the following notable terms:reflects current practices in equity incentive plans that we consider best practices, such as:

No Share Recycling. Recycling. Shares subject to equity-based awards that are cancelled, surrendered, modified, or exchanged for substitute equity-based awards, or that forfeit, expire or terminate prior to exercise or vesting in full and shares that are surrendered to the Corporationus in connection with the exercise or vesting of equity-based awards, whether previously owned or otherwise subject to such equity-based awards, may not be reissued as new equity-based awards under the 2017 Stock Plan.plan.

No Dividends on Unvested Equity Awards. Awards. Holders of unvested equity-based awards will not be entitled to dividend rights with respect to the shares of common stock constituting or subject to such unvested equity-based awards, provided that dividends otherwise payable with respect to such shares of common stock may, at the discretion of the Pension and Compensation Committee, accrue and become payable upon vesting of the equity-based awards.

Minimum Vesting Period of One Year. Year. At least 95% of all equity-based awards granted under the 2017 Stock Planplan must have a minimum vesting period of at least one year.

No Repricing. Repricing. Equity-based awards may not be repriced, replaced, regranted through cancellation, or modified without shareholder approval if such repricing, replacement, regrant or modification would reduce the exercise price of such equity-based awards.

Double-Trigger Acceleration of Vesting of Equity Awards Uponon a Change in Control. UponUnder the plan, unless otherwise stated in any award agreement or separate agreement with the participant, on a change in control of the Corporation,Chemical, the vesting of unvested equity awards would only accelerate only uponon a qualifying termination of employment and, inemployment.

Clawback Policy Implementation. All awards under the case of performance-based equity awards, wouldplan will be subject to pro rata vesting, adjustedany applicable law respecting recapture of compensation and Chemical’s clawback policy for actual performance and the fractional performance period. In addition, absent any qualifying terminationrecoupment of employment, unvested equity awards (including those that are cashed out in connection with the change in control) would remain subjectincentive compensation, as it may be amended from time to their original vesting schedules.time.

Independent Oversight. The plan will be administered by our Compensation Committee, which is a committee of independent board members.

Grant Practices

Burn rate, which is a measure of share utilization rate in equity compensation plans, is an important factor for investors concerned about shareholder dilution. Burn rate is defined as the gross number of equity-based awards granted during a calendar year divided by the weighted average number of shares of common stock outstanding during the year. The Corporation hasWe have counted full-value awards, which do not include stock options, as 3.0 shares of common stock when calculating the burn rate. TheOur board of directors believes that the Corporation’sour current three-year average burn rate for the period ended December 31, 20162018 of 1.64%1.44% compares favorably to the Institutional Shareholder Services (ISS) recommended burn rate benchmark of 2.98%2.81% for Russell 3000 (excluding S&P 500)

banking institutions for meetings occurring on or after February 1, 2017,2019, as set forth in the Appendix D to the ISS report titled “Setting the Bar for Equity-Based Compensation” published“U.S. Equity Compensation Plans Frequently Asked Questions” updated December 21, 2016.19, 2018.

|

| | | |

| Equity Award Vehicle | 2016 | 2017 | 2018 |

| A. Time-vesting RSUs - Granted | 107,665 | 100,120 | 203,482 |

| B. Performance-based RSUs - Granted (at target) | 58,211 | 69,132 | 117,561 |

| C. Performance-based RSUs - Vested | 63,917 | 58,086 | 61,852 |

| D. Restricted and Common Stock - Granted | 11,978 | 73,826 | 0 |

| E. Stock Options - Granted | 441,167 | 132,414 | 0 |

F. Total (A + C + D + E)(1) | 991,847 | 828,510 | 796,002 |

| (1) Incorporates full value share multiplier of 3.0 | | | |

| | | | |

| G. Weighted Average Common Shares Outstanding (Basic) (in thousands) | 48,952 | 70,865 | 71,338 |

| | | | |

| H. Adjusted 1-Year Burn Rate (F / G) | 2.03% | 1.17% | 1.12% |

| | | | |

| I. Adjusted 3-Year Burn Rate (Average of 2016-2018) | | | 1.44% |

TheOur board of directors does not anticipate a significant increase in the Corporation’sour average burn rate and estimates that the additional 1,750,0002,400,000 shares to be authorized for issuance under the 20172019 Stock Plan will be sufficient for threefour to four years.five years as a stand-alone company. However, assuming completion of our recently announced merger with TCF Financial Corporation, which we expect to close in the third or early fourth quarter of 2019 (subject to required shareholder and regulatory approvals), we expect the increase in our size and number of employees to cause the shares to be authorized for issuance under the 2019 Stock Plan to be sufficient for a substantially shorter period of time.

The performance-based restricted stock performance units granted in 2014, 2015,2016, 2017, 2018 and 20162019 are earned from 0.5x0% to 1.5x150% of the number of units originally granted depending on satisfaction of the established performance conditions, and vest upon satisfaction of the service requirement at the end of the restricted period. RestrictedTime-vesting restricted stock service-based units granted in 20142016 and 20152017 generally cliff vest five years after the grant date. TheTime-vesting restricted stock units granted in 2018 and 2019 generally vest in equal annual installments on each anniversary of the grant date over a five year period. Stock options granted in 2014, 2015,2016 and 20162017 vest in one-fifth incrementsequal installments on each anniversary date of the awardgrant date over the firsta five years of the option term. Restricted stock service-based units granted in 2016 cliff vest between two and five years after the grant date.year period.

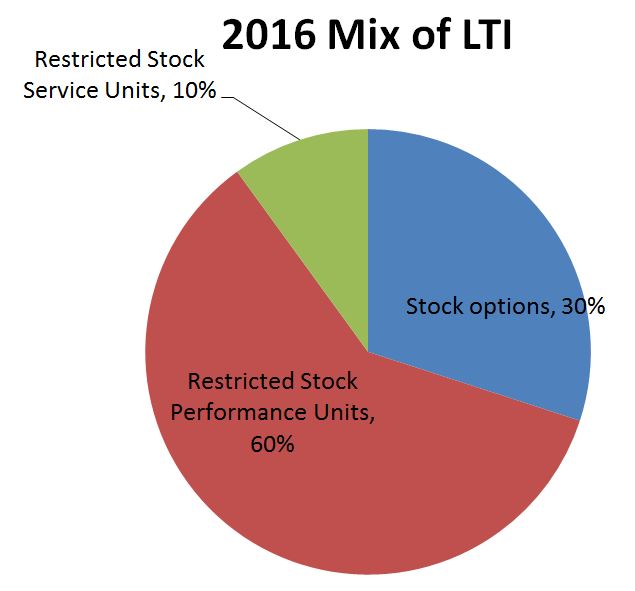

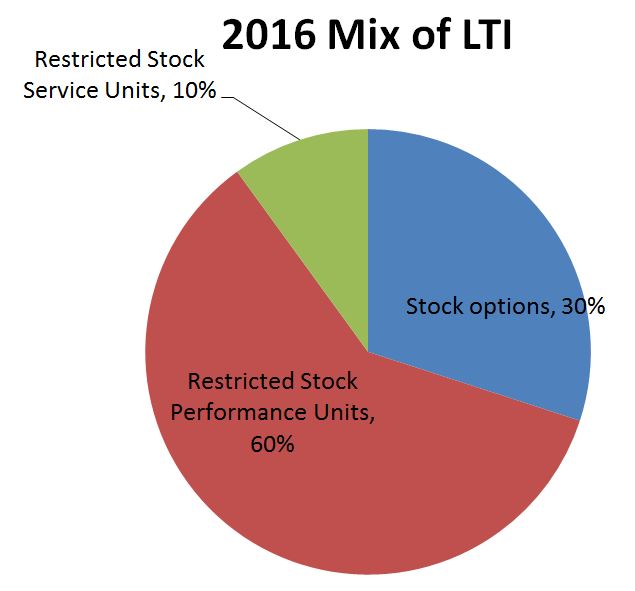

60% of the equity-based compensation awarded to the Corporation’sour Chief Executive Officer in 20162018 consisted of performance-based restricted stock units with a three-year performance units, while 30%period and 40% consisted of stock options and 10% consisted oftime-vesting restricted stock service-based units.units, which vest in equal annual installments on each anniversary of the grant date over a five year period.

Equity-based awards under the 2017 Stock Plan would be subject to the Corporation’s clawback policy.

Overhang

Overhang is a commonly used measure to assess the dilutive impact of equity programs such as the 20172019 Stock Plan. Overhang shows how much existing shareholder ownership would be diluted if all outstanding equity-based awards plus all remaining shares available for equity-based awards were introduced into the market. Overhang is equal to the number of equity-award shares currently outstanding plus the number of equity-award shares available to be granted, divided by the total diluted shares of common stock outstanding at the end of the year. TheOur board of directors believes that an overhang of less than 15% is generally considered by investors to not raise questions of excessive dilution. The 1,750,0002,400,000 shares subject to the 20172019 Stock Plan would bring the Corporation’sour aggregate overhang to 7.2%5.80%. The table below provides updated overhang data as of March 12, 2019:

|

| |

| Outstanding Equity Awards | # of Shares |

| A. Time-vesting Restricted Stock Units | 536,081 |

| B. Performance-based Restricted Stock Units | 298,911 |

C. Stock Options(1) | 680,890 |

| D. Total (A + B + C) | 1,515,882 |

| (1) Weighted average exercise price of $31.59 and weighted average remaining term of 5.58 years. |

| |

| Shares Available for Grant | # of Shares |

| E. 2017 Stock Plan (if 2019 Stock Plan approved) | 0 |

| F. Directors' Deferred Stock Plan | 232,500 |

| G. 2019 Stock Plan (if approved) | 2,400,000 |

| H. Total (E + F + G) | 2,632,500 |

| |

| I. Total Shares Outstanding + Shares Available for Grant (D + H) | 4,148,382 |

| |

| J. Common Share Outstanding as of Record Date (3/12/2019) | 71,538,472 |

| |

| K. Overhang (I / J) | 5.80% |

Purposes of 20172019 Stock Plan

TheOur board of directors believes that theour long-term interests of the Corporation are advanced by aligning the interests of its corporate and subsidiaryour officers, directors and key employees with the intereststhose of itsour shareholders through the award of equity-based awards. TheOur board of directors also believes that the award of equity-based awards isare necessary to attract, retain and motivate officers, directors and key employees of exceptional abilities, and to recognize the significant contributions these individuals have made to theour long-term performance and growth of the Corporation and its subsidiaries.growth.

We intend to use the 20172019 Stock Plan to grant equity-based awards that are predominantly performance-based restricted stock performance units and stock options. Other forms of long-term incentive compensation that we intend to award under the 2017 Stock Plan include stock options andtime-vesting restricted stock service-based units. Restricted stock, stock options, stock awards and other awards based on or related to shares of Chemical Financialour common stock may also be awarded under the 20172019 Stock Plan. By combining in a single plan many types of incentives commonly used in long-term incentive compensation programs, the 20172019 Stock Plan is intended to provide the Corporationus with a great deal of flexibility in designing specific long-term incentives to best promote the objectives of the 20172019 Stock Plan and in turn promote the interests of our shareholders.

If the 20172019 Stock Plan is approved by the shareholders, then equity-based awards could be granted to eligible participants under the 20172019 Stock Plan and no additional awards will be made under the 20152017 Stock Plan. The 20172019 Stock Plan is intended to supplement and continue the equity-based compensation policies and practices that we have used for many years. TheOur board of directors adopted and approved the 20172019 Stock Plan on February 20, 2017.March 19, 2019. If the shareholders approve the 20172019 Stock Plan on April 26, 2017,May 7, 2019, it will become effective on that date. Equity-based awards would be granted under the 20172019 Stock Plan to participants for no cash consideration or for such minimum consideration as determined by the Compensation and Pension Committee. If the 2019 Stock Plan is approved, no equity-based awards would be granted under the plan on a date that is more than ten years after the plan’s effective date. The 20172019 Stock Plan would not be qualified under Section 401(a) of the Internal Revenue Code and would not be subject to the Employee Retirement Income Security Act of 1974 (ERISA). If the 20172019 Stock Plan is not approved by the shareholders, then no equity-based awards will be effectivegranted under the 20172019 Stock Plan for any employee. No equity-based awards would be granted under the 2017 Stock Plan on a date that is more than ten years after the 2017 Stock Plan’s effective date.employee or director

The following is a summary of the material features of the 20172019 Stock Plan; however, it is not complete and, therefore, you should not rely solely on it for a detailed description of every aspect of the 20172019 Stock Plan. The summary is qualified in its entirety by reference to the terms of the 20172019 Stock Plan, a copy of which is attached as Appendix A to this proxy statement.Proxy Statement. Included in the summary is information regarding the effect of U.S. federal tax laws upon participants and the Corporation.us. This information is not a complete summary of such tax laws and does not discuss the income tax laws of any state in which a participant may reside, and is subject to change. Participants in the 20172019 Stock Plan should consult their own tax advisors regarding the specific tax consequences to them of participating in and receiving equity-based awards under the 20172019 Stock Plan.

Authorized Shares

Subject to certain anti-dilution and other adjustments, 1,750,0002,400,000 shares of Chemical Financialour common stock, $1.00 par value per share, would be available for equity-based awards under the 20172019 Stock Plan, provided that not more than 60% of such shares may be issued under awards other than stock options.Plan. Shares of common stock authorized under the 20172019 Stock Plan could be either authorized but unissued shares, shares issued and repurchased by the Corporationus (including shares purchased on the open market) or shares issued and otherwise reacquired by the Corporation.us. Shares subject to equity-based awards that are canceled, surrendered, modified, or exchanged for substitute equity-based awards, or that forfeit, expire or terminate prior to exercise or vesting in full, and shares that are surrendered to the Corporationus in connection with the exercise or vesting of equity-based awards, whether previously owned or otherwise subject to such equity-based awards, may not be reissued as new equity-based awards under the 20172019 Stock Plan. The 20172019 Stock Plan would not allow any participant to receive, in any calendar year, equity-based awards issued under the 20172019 Stock Plan with respect to more than 25% of the total number of shares available under the 20172019 Stock Plan. Upon certain changes in the number of shares of Chemical Financialour common stock outstanding (e.g., stock split, recapitalization) or the occurrence of certain corporate events (e.g., merger, stock dividend), the Compensation and Pension Committee could adjust the outstanding equity-based awards and the number of shares available for equity-based awards appropriately. If the shareholders approve the 20172019 Stock Plan, unless the 20172019 Stock Plan is terminated earlier by theour board of directors, equity-based awards could be granted at any time before April 26, 2027,May 7, 2029, when the 20172019 Stock Plan will terminate according to its terms.

Eligible Participants

OfficersApproximately 200 officers and key employees of the CorporationChemical and itsour subsidiaries couldmay receive equity-based awards under the 20172019 Stock Plan. Additionally,Officers, directors, of the Corporation and its subsidiaries may receive awards of restricted stock under the Plan exclusively in lieu of payment of the cash portion of the directors’ compensation. Officers, key employees of Chemical and directors of the Corporation and itsour subsidiaries may be considered to have an interest in the 20172019 Stock Plan because they may in the future receive equity-based awards under it.

New Plan Benefits

No equity-based awards have been granted or received under the 20172019 Stock Plan through the date of this proxy statement.Proxy Statement. Because benefits under the 20172019 Stock Plan will depend on the Compensation and Pension Committee’s actions and the fair market value of Chemical Financialour common stock at various future dates, the benefits payable under the 20172019 Stock Plan and the benefits that would have been payable had the 20172019 Stock Plan been in effect during the most recent fiscal year are not determinable.

Administration of the 20172019 Stock Plan

The 20172019 Stock Plan would be administered by the Compensation and Pension Committee. The committeeCompensation Committee would be authorized and empowered to do all things that it determined to be necessary or appropriate in connection with the administration of the 20172019 Stock Plan. The committeeCompensation Committee would determine, subject to the terms of the 20172019 Stock Plan, the persons to receive equity-based awards, the nature and amount of equity-based awards to be granted to each person (subject to the limits specified in the 20172019 Stock Plan), the time of each grant, the terms and duration of each grant, and all other determinations necessary or advisable for administration of the 20172019 Stock Plan.

Performance-Based Restricted Stock Performance Units, Time-Vesting Restricted Stock Service-Based Units, and Restricted Stock

The 20172019 Stock Plan would also permit the Compensation and Pension Committee to award restricted stock units (including both performance-based restricted stock performance units and time-vesting restricted stock service-based units) and restricted stock, subject to the terms and conditions set by the committeeCompensation Committee that are consistent with the 20172019 Stock Plan. Restricted stock units are equity-based awards denominated in units of our common stock under which the issuance of shares of our common stock is subject to such terms and conditions as the Compensation and Pension Committee deems appropriate (including achievement of performance goals established by the committee and/or continued employment)employment or service as a director). For purposes of determining the number of shares available under the 20172019 Stock Plan, each restricted stock unit would count as the maximum number of shares of our common stock subject to the restricted stock unit. Unless determined otherwise by the Compensation and Pension Committee, each earned restricted stock unit would be equal to one share of Chemical Financialour common stock and would entitle a participant to either shares of our common stock or an amount of cash determined with reference to the value of shares of our common stock.

Shares of restricted stock are shares of our common stock, the retention, vesting and/or transferability of which is subject, for specified periods of time, to such terms and conditions as the Compensation and Pension Committee deems appropriate (including achievement of performance goals established by the committee and/or continued employment)employment or service as a director).

The Compensation and Pension Committee would establish the terms of individual awards of restricted stock units and restricted stock in award agreements. Restricted stock units and restricted stock granted to a participant would “vest” (i.e., the restrictions on them would lapse) in the manner and at the times that the Compensation and Pension Committee determines. The Compensation and Pension Committee would be permitted to vary the terms, conditions and restrictions among participants and among grants to the same participant.

Unless the Compensation and Pension Committee otherwise consents or permits or unlessparticipant, including the terms ofand conditions described below.

If a restricted stock agreementdirector’s service ceases or award provide otherwise, if a participant’s employment is terminated during the restricted period (i.e., the period of time during which restricted stock units or restricted stock are subject to vesting or performance restrictions) for any reason other than death, disability, termination without cause or retirement, each unvested restricted stock unit and restricted stock award of the participant would automatically be forfeited and, in the case of restricted stock, returned to the Corporation. us.

If thea director’s service ceases or a participant’s employment is terminated during the restricted period because of death, disability or termination without cause, then, unless otherwise specified in an applicable award agreement or controlling agreement with respect to the unvested restricted stock units andparticipant, the restrictions remaining on any or all shares of restricted stock and restricted stock units would lapse and would vest automatically with respecton a prorated basis and be convertible into a number of shares of our common stock equal to (a) the number of suchthe participant’s unvested restricted stock or restricted stock units or sharesas of restricted stock (rounded to the nearest whole number) equal toeffective date of the total number of such restricted stock units or shares of restricted stock granted to such participanttermination, multiplied by (b) the quotient of (x) the number of full months that have elapsed since the later of the date of grant divided byor the most recent annual vesting date and the effective date of participant’s termination or cessation of service and (y) the total number of full months remaining in the vesting period since the later of the date of grant or the most recent annual vesting date. We currently anticipate that award agreements for our executives will provide for full vesting upon a termination of employment or cessation of service because of death, disability or termination without cause. For restricted period (providedstock or restricted stock units that any performance-basedare subject to attainment of performance goals, the number of the participant’s unvested restricted stock or restricted stock units that are subject to proration, or full vesting requirements must(if applicable), as of the effective date of his or her termination shall be satisfied before the shares may be issued).target (100%) number of restricted stock or restricted stock units set forth in the applicable equity-based award agreement. All of the unvested restricted stock units and shares of restricted stock would be forfeited and, in the case of restricted stock, returned to the Corporation;us; however, the Compensation and Pension Committee could, either before or after a participant dies or becomes disabled, waive the vesting or performance restrictions remaining on any or all of his or her remaining restricted stock units and shares of restricted stock.

If a participant who is a director ceases providing services as a director due to retirement during the restricted period, then the restrictions remaining on any or all shares of restricted stock shall terminate automatically in full upon retirement. If a participant’s employment is terminated during the restricted period due to the participant’s retirement and the participant fails to provide at least one year’s notice of retirement to the Corporation,us, each unvested restricted stock unit and share of restricted stock of the participant would automatically be forfeited and, in the case of restricted stock, returned to the Corporation.us. If the participant’s employment is terminated during the restricted period due to the participant’s retirement upon not less than one year’s notice of retirement to us, then the Corporation, then unvested restricted stock service-based units andrestrictions remaining on any or all shares of restricted stock subject solely to service-based vesting requirements would automatically vest in full, and unvested restricted stock performance units and restricted stock subject to performance-based vesting requirementsunits would lapse and would vest automatically with respect to thaton a prorated basis, or fully vest (if applicable), and be convertible into a number of restricted stock performance units and shares of restrictedour common stock subject to performance-based vesting requirements (in each case roundedin the manner applicable to the nearest whole number) equal to the respective total numbertermination of such restricted stock performance units and sharesemployment because of restricted stock granted to such participant multiplied by the number of full months that have elapsed since the date of grant divided by the total number of full months in the respective restricted period (provided that the performance-based vesting requirements must be satisfied before the shares may be issued).death, disability, or termination without cause. All of the remaining performance-based restricted stock performance units and shares of restricted stock would be forfeited and, in the case of restricted stock, returned to the Corporation;us; however, the Compensation and Pension Committee could, either before or after a participant retires, waive the vesting or performance restrictions remaining on any or all of his or her remaining restricted stock performance units or shares of restricted stock.

Without Compensation and Pension Committee authorization, until restricted stock units or shares of restricted stock vest, the recipient of the restricted stock units or restricted stock would not be allowed to sell, exchange, transfer, pledge, assign or otherwise dispose of restricted stock units or restricted stock other than by will or the laws of descent and distribution. All rights with respect to restricted stock units and restricted stock would only be exercisable during a participant’s lifetime by the participant or his or her guardian or legal representative. The Compensation and Pension Committee could impose additional restrictions on restricted stock units and shares of restricted stock. Except for restrictions on transferability, holders of restricted stock would enjoy all other rights of a shareholder with respect to the restricted stock, including liquidation and voting rights, subject to the restrictions on payment of dividends as set forth below. Unless the Compensation and Pension Committee determines otherwise, holders of restricted stock units are not entitled to liquidation or voting rights with respect to shares of common stock subject to unvested restricted stock units.

Federal Tax Consequences of Restricted Stock, Performance-Based Restricted Stock Performance Units and Time-Vesting Restricted Stock Service-Based Units

Generally, under current federal income tax laws, a participant would not recognize income upon the award of restricted stock, performance-based restricted stock performance units or time-vesting restricted stock service-based units. However, a participant would be required to recognize compensation income at the time the award vests (when the restrictions lapse) equal to the difference between the fair market value of the stock at vesting and the amount paid for the stock (if any). At the time the participant recognizes compensation income, the Corporationwe would be entitled to a corresponding deduction for federal income tax purposes, except to the extent that the deduction limits of Section 162(m) of the Internal Revenue Code apply. If restricted stock, performance-based restricted stock performance units or time-vesting restricted stock service-based units are forfeited by a participant, the participant would not recognize income with respect to the forfeited award and the Corporationwe would not receive a corresponding deduction for federal income tax purposes.

A participant could, within 30 days after the date of an award of restricted stock (but not an award of restricted stock units), elect to report compensation income for the tax year in which the restricted stock is awarded. If the participant makes this election, the amount of compensation income would be equal to the difference between the fair market value of the restricted stock at the time

of the award and the amount paid for the stock (if any). Any later appreciation in the value of the restricted stock would be treated as capital gain and recognized only upon the sale of the shares subject to the award of restricted stock. If, however, restricted stock is forfeited after the participant makes such an election, the participant would not be allowed any deduction for the amount that he or she earlier reported as income. Upon the sale of shares subject to the restricted stock award, a participant would recognize capital gain or loss in the amount of the difference between the sale price and the participant’s basis in the stock.

Stock Options

The 20172019 Stock Plan would permit the Corporationus to grant to participants options to purchase shares of Chemical Financialour common stock at stated prices for specific periods of time. For purposes of determining the number of shares available under the 20172019 Stock Plan, each stock option would count as the number of shares of common stock subject to the stock option. Stock options that could be granted under the 20172019 Stock Plan may only be nonqualified stock options and may not qualify as incentive stock options as defined in Section 422 of the Internal Revenue Code.

The Compensation and Pension Committee would establish the terms of individual stock option grants in stock option agreements. These documents would contain terms, conditions and restrictions that the committee determines to be appropriate. These restrictions could include vesting requirements to encourage long-term ownership of shares. The Compensation and Pension Committee would be permitted to vary the terms, conditions and restrictions among participants and among grants to the same participant.

The exercise price of a stock option would be determined by the Compensation and Pension Committee, but must be at least 100% of the market value of Chemical Financialour common stock on the date of grant. No stock option could be repriced, replaced, regranted through cancellation or modified without shareholder approval if the effect of such repricing, replacement, regrant or modification would be to reduce the exercise price of such stock options to the same participants.

When exercising all or a portion of a stock option, a participant couldmay pay the exercise price with cash or, if permitted by the Compensation and Pension Committee, shares of Chemical Financialour common stock. The committeeCompensation Committee could also authorize payment of all or a portion of the exercise price in the form of a promissory note or installment payments, except as limited by the Sarbanes-Oxley Act of 2002 or other laws, rules or regulations. Any promissory note or installment payments must be with full recourse and at the market rate of interest. TheOur board of directors couldmay restrict or suspend the power of the committeeCompensation Committee to permit such loans, however, and could require that adequate security be provided. In addition, the Compensation and Pension Committee may allowallows broker-assisted cashless exercises of stock options.

Although the term of each stock option would be determined by the Compensation and Pension Committee, no stock option would be exercisable under the 20172019 Stock Plan more than ten10 years and one day after the date it was granted. Stock options generally would be exercisable for limited periods of time if an option holder dies, becomes disabled, retires, is terminated without cause, or voluntarily leaves his or her employment or service to the extent that such options were exercisable on the date of the option holder’s death, disability, or termination of employment. If an option holder is terminated for cause, the option holder would forfeit all rights to exercise any outstanding stock options. Subject to the other terms of the 2017 Stock Plan, if an option holder retires (as specified in the 2017 Stock Plan) as an employee, he or she could exercise options in accordance with their terms following retirement, unless the terms of the option agreement or award provide otherwise.

Restrictions on Transfer

Without Compensation and Pension Committee approval, stock optionsconsent or permission, a participant cannot sell, exchange, transfer, pledge, assign or otherwise dispose of an equity-based award granted under the 20172019 Stock Plan generally could not be transferred, exceptother than by will or by the laws of descent and distribution, unless transfer is permitteddistribution. All rights with respect to equity-based awards would only be exercisable during a participant’s lifetime by the terms of the grantparticipant or the applicable stock option agreement.his or her guardian or legal representative. The committeeCompensation Committee could impose otheradditional restrictions on shares of common stock acquired through a stock option exercise.equity-based awards.

Federal Tax Consequences of Stock Options

The 20172019 Stock Plan only provides for awards of nonqualified stock options – those options that do not meet the Internal Revenue Code’s definition of an incentive stock option. Under current federal income tax laws, an option holder would not recognize any income and the Corporationwe would not receive a deduction for federal income tax purposes when a nonqualified stock option is granted or vests. If a nonqualified stock option is exercised, the option holder would recognize compensation income equal to the difference between the exercise price paid and the market value of the stock acquired upon exercise (on the date of exercise). The CorporationWe would then receive a corresponding deduction for federal income tax purposes, except to the extent that the deduction limits of Section 162(m) of the Internal Revenue Code apply. The option holder’s tax basis in the shares acquired would be the exercise price paid plus the amount of compensation income recognized. Sale of the stock after exercise would result in recognition of short-term or long-term capital gain (or loss).

Other Stock-Based Awards

The 20172019 Stock Plan would also permit the Compensation and Pension Committee to grant a participant one or more types of awards in the form of Chemical Financialour common stock or based on, or related to, shares of Chemical Financialour common stock, other than the types described above. The committee

Compensation Committee could make stock awards for any amount of consideration, or no consideration, as the committeeCompensation Committee determines. Any such awards would be subject to terms and conditions as the Compensation and Pension Committee deems appropriate, as set forth in the respective award agreements and as permitted under the 20172019 Stock Plan. Stock award recipients would generally have all voting, liquidation and other rights with respect to awarded shares of Chemical Financialour common stock upon becoming the holder of record of the common stock granted pursuant to the award, subject to the restrictions regarding payment of dividends as set forth below. However, the committeeCompensation Committee could impose restrictions on the assignment or transfer of common stock awarded under the 20172019 Stock Plan.

Federal Tax Consequences of Other Stock-Based Awards